2025 Gift Allowance

Blog2025 Gift Allowance. In 2026, the limit drops to $7 million. The lifetime gift tax exemption allows you to make large gifts without incurring gift taxes.

In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025). Annual federal gift tax exclusion.

Irs has issued proposed regs and a news release concerning various effects of the increase in gift and estate tax exclusion amounts that are in effect from.

The 2017 tax cuts and jobs act (tcja) nearly doubled the lifetime estate and gift tax exemption from $5.6 million to $11.18 million for.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, Now’s the time to review your plans and. Learn more about planning considerations for both you and your business in regards to the 2025 estate and gift tax exemption sunset so you can plan ahead.

Employee Tax Benefits Corporate Solutions Zaggle Save, Elevated gift tax exclusions will sunset after 2025. For planning purposes, we estimate that the exemption will be roughly cut in half, perhaps from $14 million in 2025 to $7 million in 2026.

Gift Allowance 2025 Lura Mellie, In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025). Learn more about planning considerations for both you and your business in regards to the 2025 estate and gift tax exemption sunset so you can plan ahead.

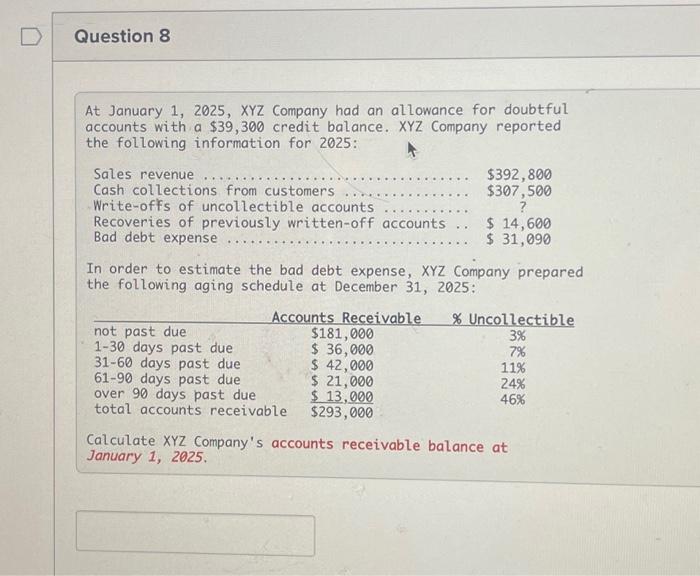

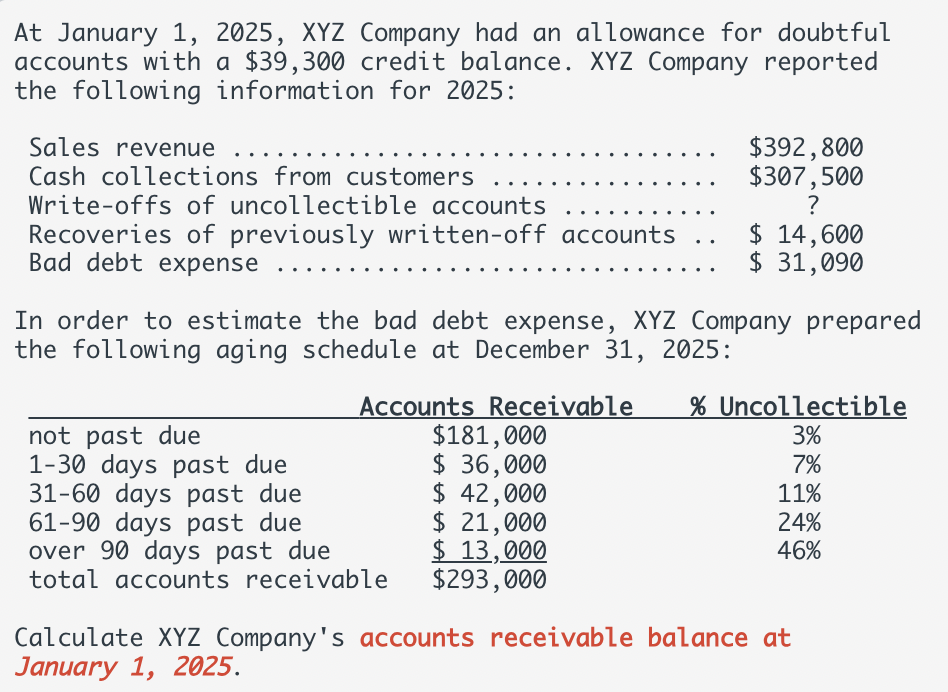

Solved At January 1, 2025, XYZ Company had an allowance for, There's no limit on the number of individual gifts that. In 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability.

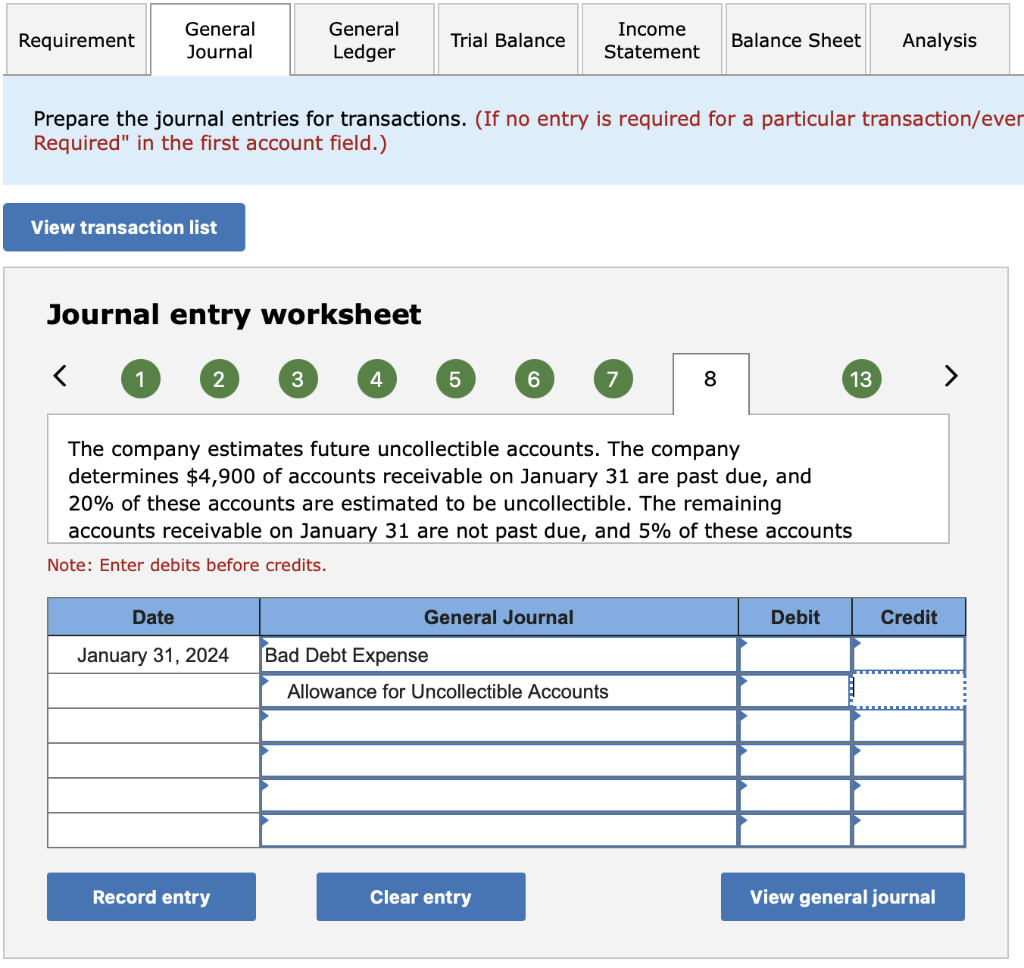

![[Solved] Presented below are selected transactions](https://media.cheggcdn.com/study/be6/be6c065b-0881-45fe-8ac7-038a7f61ea1b/image.jpg)

Solved At January 1, 2025, XYZ Company had an allowance for, The current estate and gift tax exemption is scheduled to end on the last day of 2025. Now’s the time to review your plans and.

[Solved] Presented below are selected transactions, In addition, gifts from certain relatives such as parents, spouse and siblings are also exempt from. With the increased exemption amount through 2025, certain lifetime gifting strategies can be implemented now, before the sunset, to reduce estate values and.

The Christmas gift allowance how it works Davis Grant, 50,000 per annum are exempt from tax in india. Irs has issued proposed regs and a news release concerning various effects of the increase in gift and estate tax exclusion amounts that are in effect from.

How Much Is The NSFAS Allowance in 20242025?, Learn more about planning considerations for both you and your business in regards to the 2025 estate and gift tax exemption sunset so you can plan ahead. In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025).

The Christmas gift allowance how it works Richard Anthony, Simply put, these taxes only apply to large gifts made by a person while they. You have no exemption left.

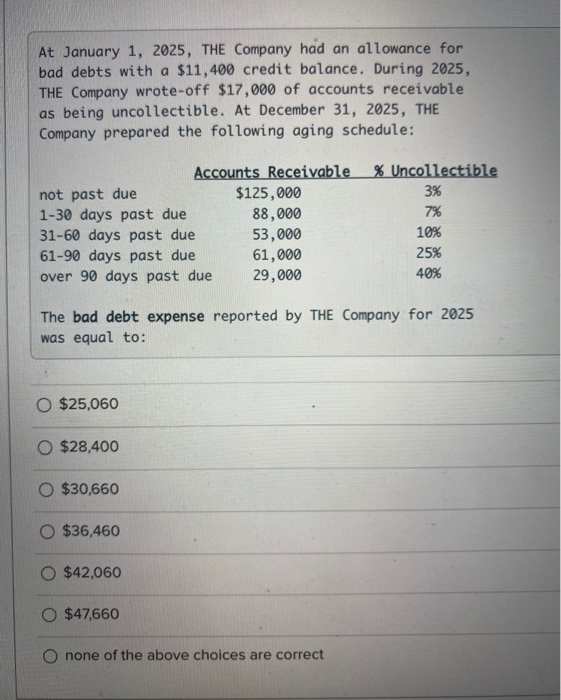

Solved At January 1, 2025, THE Company had an allowance for, Elevated gift tax exclusions will sunset after 2025. Learn how to help your clients make the most of it now.